July 9, 2025

Navigating the Tightrope of Trust Accounting: Essential Strategies for Law Firms

Managing client funds with precision is paramount in the legal field, where even a minor slip can lead to severe consequences including ethics violations or disbarment. Understanding trust accounting and implementing robust three-way reconciliation processes is critical for any law firm aiming to stay compliant and efficient.

Trust accounting involves the meticulous handling of funds that law firms hold on behalf of clients, such as advance retainers or settlement funds. These are deposited into distinct client trust accounts, often known as IOLTA accounts, ensuring they remain separate from the firm’s operational funds. This separation is crucial; commingling of these funds is a strict no-go.

The procedure requires rigorous documentation for every transaction. Modern legal-specific software has made this easier by automatically categorizing transactions and assigning them to individual client ledgers, thus simplifying compliance and reducing errors.

The stakes of mishandling trust accounting are high. Many state bars perform random audits, and discrepancies can lead to disciplinary actions. According to the 2025 Legal Industry Report, 49% of firms find trust accounting moderately or significantly challenging, and 61% struggle with accounting overall. The complexity and compliance burden are particularly acute for smaller practices.

One of the most effective methods to ensure accurate trust accounting is through three-way reconciliation, a process that compares the trust account bank statement, the firm's trust ledger, and individual client ledgers to ensure they all match exactly. Any discrepancies must be resolved promptly. While some jurisdictions allow quarterly reconciliation, monthly checks are considered best practice.

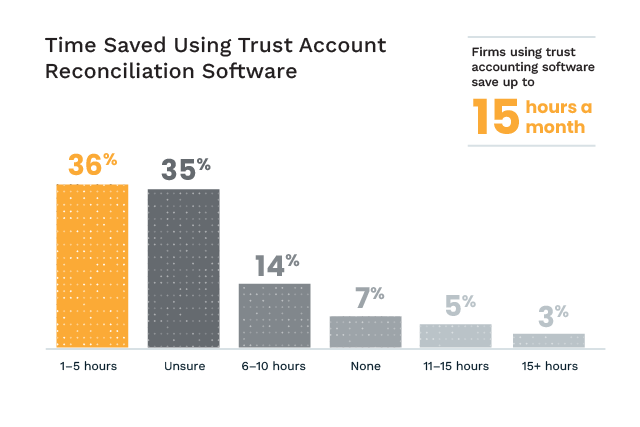

In the past, three-way reconciliation involved cumbersome spreadsheets and manual calculations. Today, tools like MyCase Accounting automate much of this work, offering auto-matched transactions, real-time balances, integrated payment workflows, and instant reconciliation reports. Such tools not only minimize human error but significantly cut down on the time spent on these tasks—up to 15 hours a month according to recent data.

Best practices in trust accounting and reconciliation include maintaining separate accounts for client funds and operating expenses, documenting all transactions comprehensively, reconciling accounts monthly, avoiding bank fees on trust accounts, assigning specific personnel for reconciliation tasks, and utilizing legal-specific software for enhanced accuracy and efficiency.

By integrating these practices and leveraging advanced tools like MyCase, law firms can transform trust accounting from a daunting task to a streamlined process, thereby building stronger trust with clients and staying on the right side of regulators. Interested firms can explore these benefits further by scheduling a demo with MyCase, ensuring they remain audit-ready and efficient in managing client funds.