August 11, 2025

Second Quarter Brings Uncanny Stillness to Law Firms Amidst Tariff Economy Tensions

In the latest Law Firm Financial Index, Thomson Reuters draws a vivid comparison between the current state of the legal market and the eye of a storm. This metaphor suggests a deceptive tranquility that precedes inevitable tumult, likening the present conditions to a horror movie's tense quiet before chaos resumes.

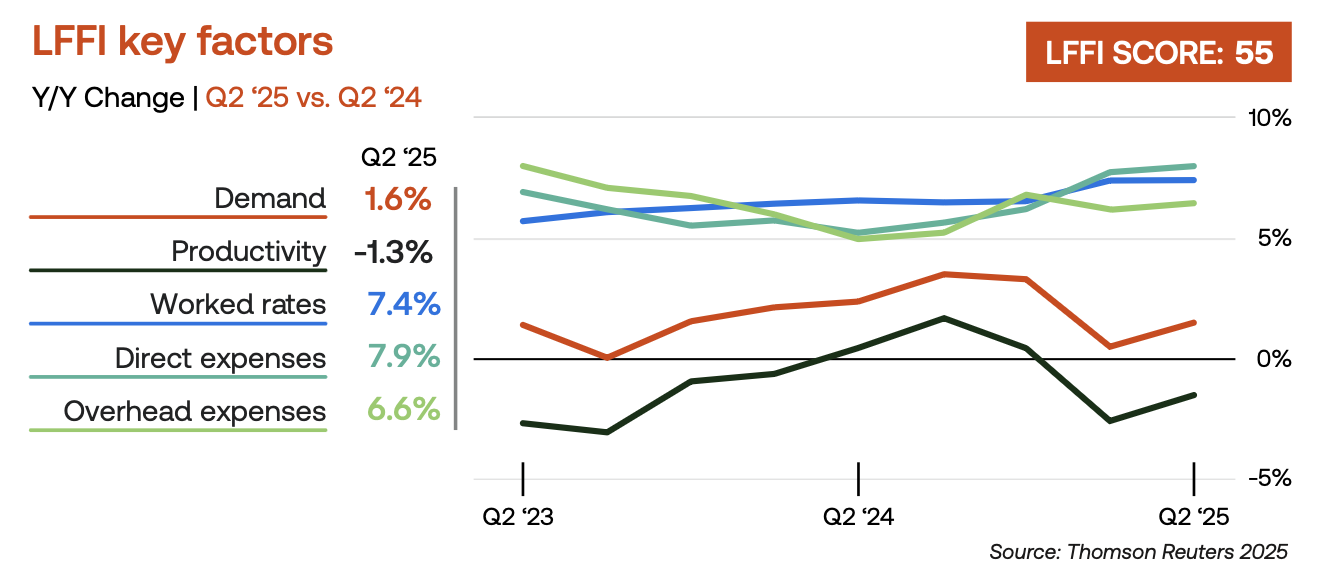

During Q2 of 2025, law firms experienced a period of unusual calm, marked by a slight increase in demand and the least volatility noted since the unsettling days of 2020, and reminiscent of the stability last seen before the Great Recession. Yet, the serenity might be misleading, as the Index report ominously suggests with the headline, “Everything’s Fine, Which Is Exactly Why You Should Panic.” The calm in the sector could very well be the proverbial calm before the storm, akin to the disquieting silence when a horror film’s soundtrack hushes and danger lurks just off-screen.

As clients increasingly sought legal advice, likely driven by the uncertain economic climate, there was a noticeable dip in realization rates during Q2, hinting at a potential tightening of belts among clients. The most robust growth was observed in countercyclical sectors like litigation, while mergers and acquisitions, after a strong start to the year, began to falter. This juxtaposition paints a picture of a sector braced for potential hardship, mirroring the tension-filled pause in a thriller.

Adding to the complexity, the costs associated with staying competitive, particularly in the AI technology race, continued to escalate. Interestingly, the economic landscape of Q2 saw midsize and Second Hundred firms outperforming their larger Am Law 100 counterparts in terms of demand growth across most practice areas. This shift is significant as these firms not only caught up but, in some instances, surpassed the fee growth of the traditionally dominant top-tier firms.

This nuanced performance across different firm sizes illustrates a legal industry at a critical juncture. While larger firms have curtailed lawyer head-count growth, especially within their corporate practices, smaller firms have seen a surge in demand that has propelled their financial success above that of their larger counterparts.

Is this period truly the "eye" of the storm, suggesting a temporary reprieve, or is it the eerie calm before a more severe economic storm hits the legal sector? With no clear end in sight, the sector remains on edge, much like viewers awaiting the next plot twist in a suspense-filled movie.

In essence, the second quarter of 2025 delivered an eerie calm for law firms, loaded with both foreboding and opportunity, making it a period of strategic importance and vigilant observation for the future.