January 7, 2026

The Illusion of Prosperity in the Legal Industry: A Precursor to Layoffs?

The latest annual State of the U.S. Legal Market report by the Thomson Reuters Institute and Georgetown Law’s Center on Ethics and the Legal Profession presents a paradoxical picture of the legal industry’s current prosperity. According to the report, the legal sector is experiencing a boom, with profits and demand at their highest in over a decade. The top law firms are thriving, midsize firms are seizing their moment, and there’s a general air of self-congratulation over the industry's resilience.

However, historical patterns suggest caution. The report draws an unsettling parallel between today’s market exuberance and previous periods of financial upheaval, such as the pre-2007 Global Financial Crisis and the 2021 inflationary period. Each instance of such prosperity was followed by a significant market correction, affecting those who mistook temporary success for long-term stability the hardest.

The report employs a metaphor comparing the legal market's rapid expansion to the tectonic forces that formed the Himalayas, suggesting that the same forces propelling the industry to new heights are also undermining its stability. This boom is largely driven by legal complexities arising from geopolitical instability, regulatory changes, and trade wars, which have increased the demand for both transactional and counter-cyclical legal work.

Adding to the complexity, law firms have significantly increased their spending on artificial intelligence, aiming to streamline operations and reduce the time required for routine tasks. Despite these technological advancements, the traditional hourly billing model still dominates, creating what the report describes as "an almost absurd tension." This discrepancy raises questions about the sustainability of current business practices in the legal field.

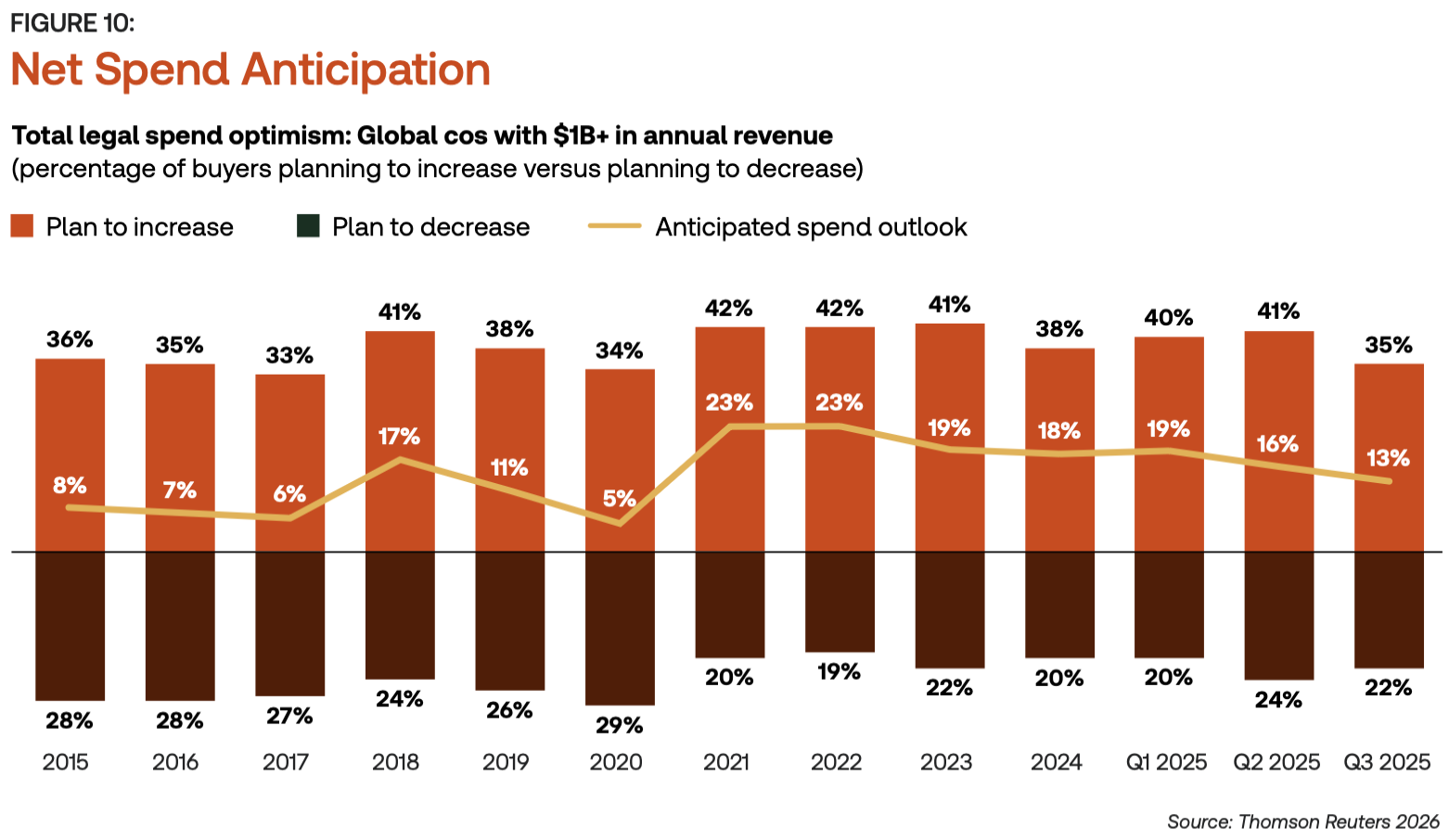

Furthermore, a phenomenon the report calls the "client value squeeze" highlights the growing reluctance of corporate legal departments to continue paying premium rates without seeing proportional value, particularly given the technological efficiencies now available. This tension is leading clients to demand more innovative billing solutions, but many law firms remain resistant to moving away from hourly rates.

The disparity in growth rates between the largest firms and midsize firms illustrates a shifting landscape. While the top firms struggle to maintain demand, midsize firms are experiencing robust growth, benefiting from their ability to offer competitive rates and similar technological capabilities.

The report warns that the current market conditions may not be sustainable and suggests that a downturn could be imminent. It draws an analogy with the aftermath of the 2008 financial crisis when corporate legal departments absorbed laid-off talent, leading to increased scrutiny and pressure on law firms to justify their fees.

In conclusion, while the legal industry may currently appear to be thriving, underlying tensions and historical precedents suggest that firms should prepare for potential challenges ahead. The reliance on outdated billing models in an era of technological advancement and the increasing sophistication of clients in managing legal costs could herald significant changes in how legal services are valued and delivered.