February 17, 2026

Supreme Court Finally Adopts Conflict-Checking Software, Two Decades Behind Lower Courts

In a move that could be described as "better late than never," the U.S. Supreme Court has finally decided to employ conflict-checking software to aid justices in identifying potential conflicts of interest in cases they handle. This decision, announced on Tuesday, comes about 20 years after similar technology was adopted by lower courts during the George W. Bush administration.

The software aims to prevent justices from participating in cases where they might have financial interests, a basic ethical standard already in place for other federal judges. However, the Supreme Court's approach lacks the enforceable bite found in lower courts, relying instead on a self-regulated promise, informally referred to as a "14-page pinky swear" by critics.

For years, the Supreme Court's recusal process has been as organized and transparent as a chaotic fantasy football league draft, with no significant updates since they first hinted at adopting such software back in 2023. After 827 days of silence and inaction, this implementation might seem like a small step forward, but for many, it's too little, too late.

Gabe Roth, from the advocacy group Fix the Court, pointed out that this new rule would primarily affect only two of the nine justices — Chief Justice Roberts and Justice Alito, who together account for a significant portion of the Court's recusals due to their individual stock holdings. Roth argues that a more effective ethical reform would be a complete divestment from individual stocks by all justices, a standard already adopted by seven of the nine justices who instead choose blended or mutual funds to minimize conflicts.

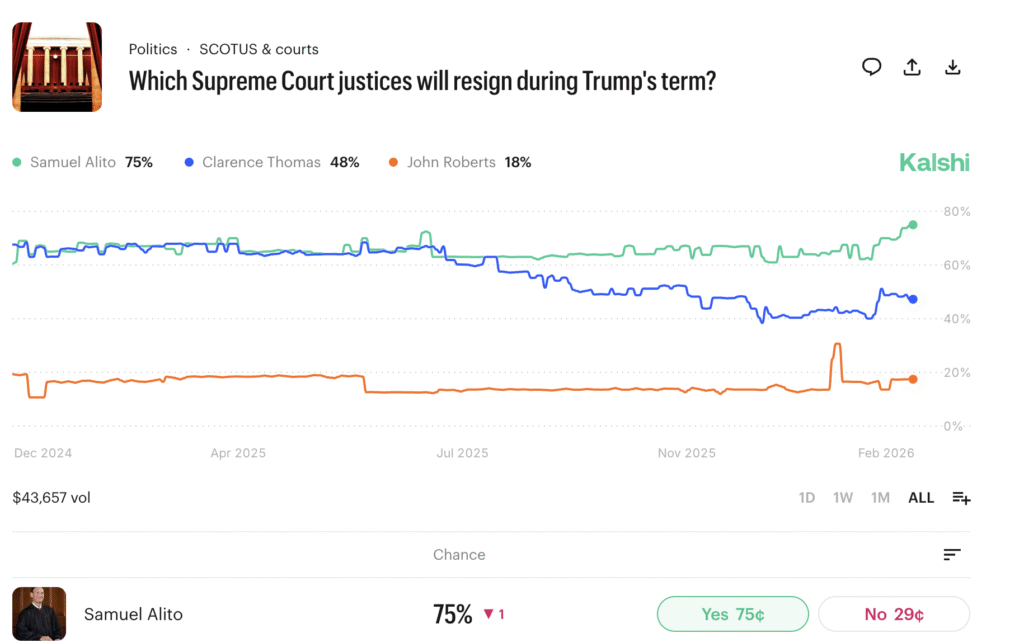

This ethical quagmire is further complicated by ongoing speculations about Justice Alito’s potential retirement, fueled by planned book releases and tour dates coinciding with the Supreme Court's next term. His significant investments in the fossil fuel sector, highlighted during his last-minute recusal from a major environmental case, underscore the ongoing challenges and perceived conflicts within the highest court.

The reluctance to adopt more rigorous ethical standards reflects broader concerns about transparency and accountability at the Supreme Court. Critics, including Roth, argue for the need for public input and a more formal legislative framework to govern the ethics of the U.S. judiciary. Current proposals to ban stock ownership among federal judges are being diluted in Congress, illustrating the uphill battle for meaningful reform.

As the Supreme Court continues to wield immense power over American law and life, the calls for stronger ethical safeguards grow louder. Yet, with the latest software adoption, the Court's commitment to these ideals remains, at best, a work in progress.